Not known Details About Pvm Accounting

Not known Details About Pvm Accounting

Blog Article

See This Report about Pvm Accounting

Table of ContentsPvm Accounting for DummiesSome Of Pvm AccountingHow Pvm Accounting can Save You Time, Stress, and Money.About Pvm Accounting3 Simple Techniques For Pvm AccountingSome Known Details About Pvm Accounting

Supervise and handle the production and approval of all project-related payments to clients to cultivate great interaction and prevent concerns. financial reports. Guarantee that suitable records and documentation are sent to and are upgraded with the IRS. Make certain that the bookkeeping procedure complies with the legislation. Apply called for building audit standards and procedures to the recording and coverage of building and construction activity.Communicate with various funding companies (i.e. Title Business, Escrow Business) relating to the pay application procedure and needs required for settlement. Aid with applying and maintaining internal financial controls and procedures.

The above statements are meant to explain the general nature and degree of job being performed by people designated to this category. They are not to be understood as an extensive checklist of obligations, tasks, and skills called for. Personnel may be required to carry out tasks beyond their regular duties periodically, as required.

5 Simple Techniques For Pvm Accounting

You will aid support the Accel group to make sure shipment of effective in a timely manner, on budget, tasks. Accel is seeking a Building and construction Accounting professional for the Chicago Office. The Building and construction Accountant executes a range of accounting, insurance conformity, and task administration. Functions both separately and within details departments to keep financial documents and make sure that all documents are maintained current.

Principal duties consist of, however are not restricted to, taking care of all accounting functions of the business in a prompt and exact manner and providing reports and timetables to the company's CPA Company in the prep work of all financial statements. Guarantees that all accounting procedures and features are handled properly. In charge of all monetary records, pay-roll, financial and day-to-day procedure of the audit feature.

Prepares bi-weekly trial balance reports. Works with Task Supervisors to prepare and upload all regular monthly invoices. Processes and concerns all accounts payable and subcontractor repayments. Produces regular monthly recaps for Employees Settlement and General Obligation insurance coverage premiums. Generates month-to-month Work Expense to Date reports and working with PMs to integrate with Task Managers' budgets for each task.

The 9-Minute Rule for Pvm Accounting

Proficiency in Sage 300 Building And Construction and Realty (formerly Sage Timberline Workplace) and Procore construction administration software a plus. https://pvmaccount1ng.bandcamp.com/album/pvm-accounting. Have to likewise excel in other computer software program systems for the preparation of records, spreadsheets and various other bookkeeping evaluation that may be needed by management. construction bookkeeping. Have to possess strong business abilities and capability to focus on

They are the financial custodians who make certain that construction jobs continue to be on budget, abide by tax obligation regulations, and preserve economic openness. Construction accounting professionals are not simply number crunchers; they are strategic partners in the building procedure. Their key role is to manage the monetary facets of construction projects, making sure that sources are alloted efficiently and monetary threats are minimized.

The 9-Second Trick For Pvm Accounting

By keeping a limited hold on project funds, accountants aid protect against overspending and economic obstacles. Budgeting is a keystone of effective building jobs, and building and construction accounting professionals are important in this regard.

Navigating the complex web of tax policies in the construction industry can be challenging. Building accounting professionals are well-versed in these regulations and guarantee that the task adheres to all tax obligation demands. This consists of managing pay-roll tax obligations, sales taxes, and any kind of various other tax obligation responsibilities specific to building and construction. To stand out in the function of a construction accountant, people require a solid academic structure in bookkeeping and money.

In addition, qualifications such as Qualified Public Accounting Professional (CERTIFIED PUBLIC ACCOUNTANT) or Qualified Building And Construction Industry Financial Specialist (CCIFP) are Get More Info highly pertained to in the sector. Building and construction jobs commonly include tight deadlines, transforming laws, and unforeseen costs.

How Pvm Accounting can Save You Time, Stress, and Money.

Professional accreditations like certified public accountant or CCIFP are likewise highly recommended to show knowledge in building and construction audit. Ans: Construction accounting professionals produce and keep an eye on budget plans, determining cost-saving chances and making sure that the project remains within budget. They also track expenses and forecast financial demands to stop overspending. Ans: Yes, building and construction accounting professionals manage tax conformity for building projects.

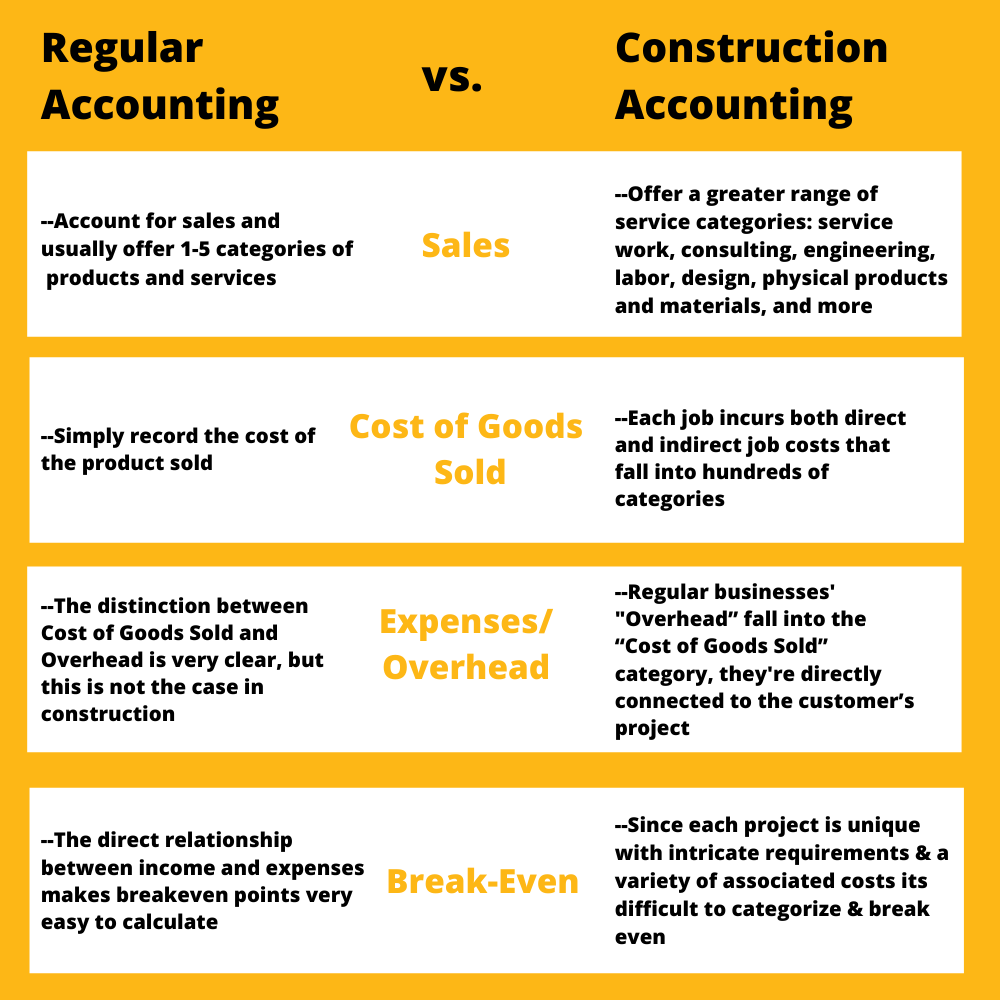

Intro to Building Accounting By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Construction companies need to make challenging selections among several monetary choices, like bidding on one task over another, picking financing for materials or equipment, or setting a project's revenue margin. Building and construction is a notoriously unstable sector with a high failure rate, slow-moving time to payment, and irregular cash money flow.

Manufacturing includes duplicated processes with conveniently identifiable prices. Production calls for different procedures, materials, and devices with varying expenses. Each task takes location in a new place with differing website problems and distinct obstacles.

Pvm Accounting for Dummies

Durable relationships with vendors alleviate negotiations and enhance performance. Irregular. Frequent use various specialty service providers and providers influences performance and capital. No retainage. Repayment arrives completely or with normal payments for the full agreement amount. Retainage. Some portion of payment may be held back until project completion even when the service provider's work is ended up.

Regular manufacturing and temporary agreements result in workable cash flow cycles. Uneven. Retainage, slow-moving repayments, and high in advance costs lead to long, irregular cash money circulation cycles - construction bookkeeping. While traditional manufacturers have the benefit of regulated atmospheres and optimized manufacturing processes, construction firms need to regularly adapt per new project. Also somewhat repeatable tasks need modifications as a result of site problems and other factors.

Report this page